Sell. Learn. Stay Ahead.

Turn every payment into action — instant payouts, rich insights, smarter marketing.

Ultra-low fees. Same-day settlements. Loyalty that drives growth. Insights you can act on. No terminals. Just results.

Request a Demo Pre-order Now

Simple, Secure Payments in Seconds

No expensive card readers. No complicated setup. Just fast, direct bank payments your customers will love.

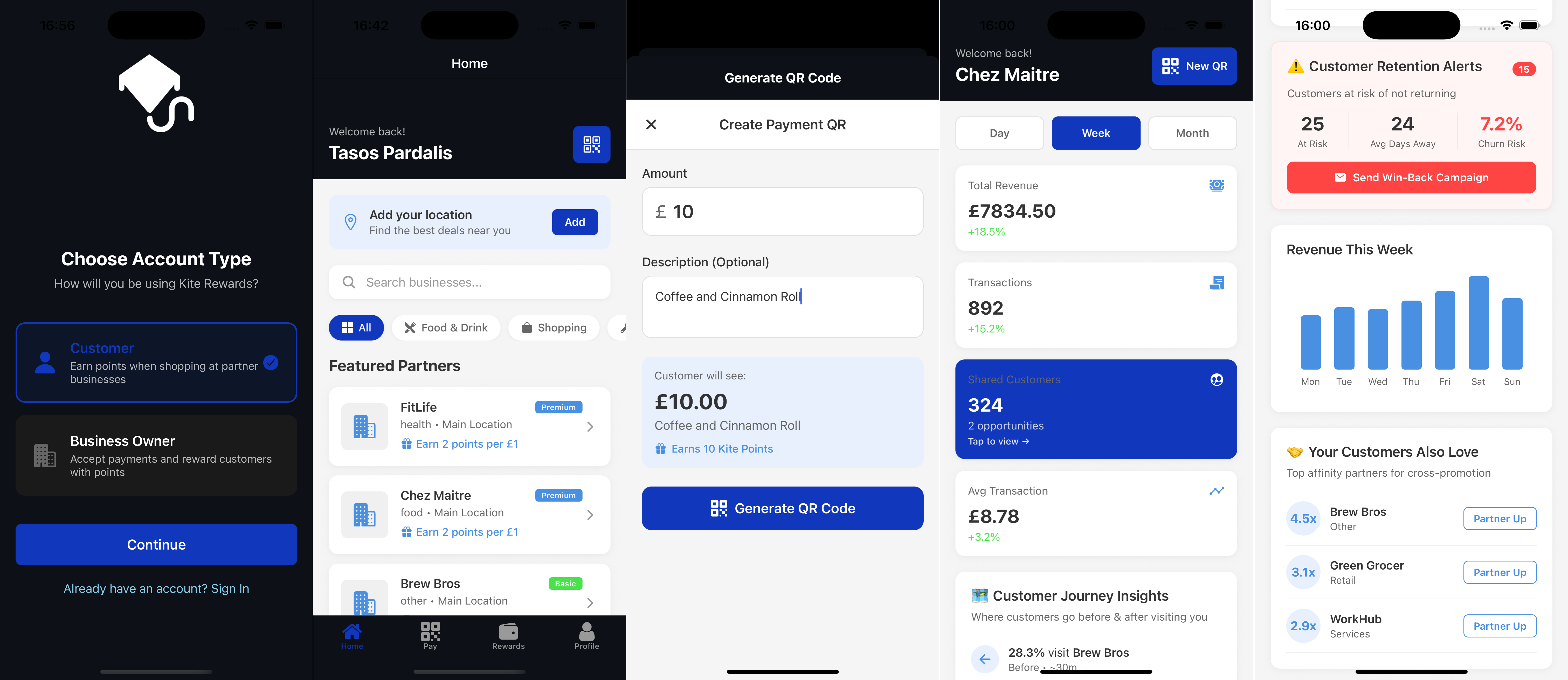

1. Generate a QR Code

Enter the payment amount in your KiteIQ app to instantly create a unique, secure QR code.

2. Customer Scans to Pay

Your customer scans the code with their phone and approves the payment directly from their banking app.

3. Money Arrives Instantly

The funds land in your business account in seconds, not days. Improve your cash flow overnight.

Keep More of Your Money

Tired of losing 1.2%-3% of every sale to card fees? Our Open Banking payments are radically cheaper, with fees from just 0.6% to 0.8%.

Instant settlements to improve cash flow. No hardware or POS integration needed. Works for in-store QR codes and on your website.

Watch the QR Code Payment in Action

See how easy it is for your customers to pay via bank — no terminals, no cards, just scan and done.

Customer scans QR code using their phone's camera Customer sees option to "Pay with my bank" Customer approves payment and money goes from customer's bank account directly to merchant's bank account

Data That Actually Helps You Grow

Go beyond simple sales numbers. KiteIQ provides the most comprehensive insights of any POS system, with actionable recommendations built-in.

See customer journey paths before and after they visit you. Identify customers at risk of churn and win them back. Discover strategic collaboration opportunities with other local businesses.

Turn First-Time Visitors into Loyal Fans

Our built-in points system motivates customers to return. Every time a customer pays with Kite Pay, they earn points, strengthening their connection to your business.

Reward customers with 1, 2, or 3 points per £1 spent. Run custom promotions like "Double Points Tuesdays". Get featured on the KiteIQ app homepage to attract new customers.

🚀 KiteIQ is in early access. Join now to help shape the product and lock in discounted pricing.

Simple, Transparent Pricing

Choose the plan that fits your business. No hidden fees, no long-term contracts.

For businesses starting out who want simple payments, basic insights, and access to rewards.

+ 0.8% per transaction

Kite Pay: 0.8% fee Kite Insights (Basic): Revenue, Transactions, Avg Spend Kite Rewards: 1 point per £1 Basic promotion templates Standard app listing

Designed for growth-focused businesses that want to convert data into action.

+ 0.8% per transaction

Everything in Starter, plus: Insights (Advanced):Churn prediction, customer journeys, collaboration tools Targeted offers to at-risk customers KiteIQ Boost: 1 points per £1 Custom promotions & A/B testing Marketing placements on homepage

For brands that want to dominate locally and nationally with premium tools and lower fees.

+ 0.80% per transaction

Everything in Growth, plus: Lower Transaction Fees: 0.80% Priority support & onboarding KiteIQ Premium: 1 points per £1 Cross-promotion campaigns Advanced AI Marketing Recommendayions Early access to new features

Tailored for companies that want a smaller transaction fee.

0.50% for first 10,000 transactions/month

Everything in Scale Ultra low transaction Fees: 0.50%

How KiteIQ Pays for Itself — UK Numbers

These aren’t U.S. case studies. They’re directly from UK businesses and consumers.

📊 Sales from Loyalty Members

Loyal customers at Butcombe pubs accounted for 22% of all sales.

– Butcombe & industry reports

🙋 UK Consumer Engagement

80–91% of UK consumers actively hold or use loyalty cards monthly.

– Statista, GCVA surveys

💷 Loyalty Savings

UK loyalty members saved an average of 17–25% on loyalty‑priced products at supermarkets.

– UK CMA report

🔁 Visit Frequency Leverage

Over 54% of UK adults return to restaurants they’ve visited before—and are more likely to choose ones offering rewards.

– NIQ / Cardlytics UK hospitality data

UK-Based Data: What Analytics & Marketing Automation Can Do

KiteIQ delivers real growth—not guessing games—using tools proven to move the needle in UK small businesses.

📈 Marketing Automation

+14.5% productivity in sales and 12% lower marketing costs.

UK small business benchmarks

🎯 Analytics & Personalisation

UK hospitality operators who use data-driven marketing see 10–20% revenue growth.

From McKinsey / HVS London insights

📊 Hospitality Software ROI

Analytics systems delivered an average of +15% revenue growth at UK venues.

Based on real hospitality case studies

📌 Example: If your average customer spends £15 and you take 200 visits a month (totaling £3,000 in sales), KiteIQ tools can drive:

- +10% from loyalty & repeat visits ⇒ +£300

- +8% from targeted email/app offers ⇒ +£240

- Total uplift ~18% → £540/month

All this for less than your barista staffing costs. That’s ROI you can bank on.

Why Pay More for Less?

Here’s how KiteIQ compares to the “big names” — at a fraction of the cost.

| Feature | HubSpot Free / £702+ |

Mailchimp Free / £280+ |

KiteIQ £50–£200 |

|---|---|---|---|

| Customer contact list (CRM) | ✅ Basic / ✅ Advanced | ⚠️ Limited by audience tier | ✅ Built-in via payment data |

| Real-time purchase/spend data | ❌ | ❌ | ✅ Via Open Banking |

| Visit-based behavioural segmentation | ❌ / ✅ | ⚠️ In higher plans | ✅ From Growth plan (£129.99+) |

| Loyalty & rewards system | ❌ | ❌ | ✅ Fully integrated |

| Marketing automation | ❌ / ✅ | ⚠️ Basic / ✅ Advanced | ✅ Built-in recommendations |

| A/B testing | ❌ / ✅ | ⚠️ In Premium | ⚠️ Not needed — performance data driven |

| In-app promotions & customer offers | ❌ | ❌ | ✅ From Growth plan (£129.99+) |

| Setup complexity | ⚠️ Weeks to configure | ⚠️ Multiple templates required | ✅ Plug & play |

| Monthly Cost | Free – £702+ | Free – £280+ | £50 – £200 |

*Feature availability may vary depending on plan. Some features like in-app promotions and behavioural segmentation are available from the Growth tier (£129.99/month) and up. Early adopters may receive these features temporarily across all plans during the pre-launch period.

💡 Pricing and features shown are part of our pre-launch phase and may change. Deposits are fully refundable.

Ready to Join KiteIQ?

We're inviting early businesses to pre-order now. Pay a small deposit to secure your spot. Full product launch coming later this year.

Choose your plan below and request a deposit link and request a demo:

Starter – Request £10 Link Growth – Request £25 Link Scale – Request £40 Link Partner – Contact Us👀 We’re offering early access pricing for a limited number of partners. Deposits are fully refundable if the product does not launch by May 2026.

Frequently Asked Questions

We use Open Banking APIs to facilitate direct bank-to-bank payments. This cuts out the traditional middlemen like Visa and Mastercard, along with their associated scheme fees. By creating a more direct path for your money, we pass the savings directly onto you.

Absolutely. Open Banking is a government-led initiative in the UK and is regulated by the Financial Conduct Authority (FCA). It uses the same rigorous security protocols that your own banking app uses. Customers must authenticate every payment within their own secure banking environment, making it one of the safest payment methods available.

We support payments from all major UK banks, including Barclays, HSBC, Lloyds, NatWest, Santander, Monzo, Starling, Revolut, and many more. If your customer has a UK banking app on their phone, they can pay with Kite Pay.

Our mission is to provide the lowest possible fees and instant access to your funds. Credit card networks add significant costs and delays. By focusing on direct bank payments, we can deliver on our promise of better cash flow and higher margins for your business. We are constantly evaluating the payment landscape and may consider other options in the future if they align with our core principles.